CAPITAL AND SYNERGIES IN REAL ESTATE

ENTREPRENEURIAL REAL ESTATE PROJECTS:

WE ARE YOUR IDEAL PARTNER

1

Capital

+

+

1

Synergies

=

=

3

Sucess

About Us

MOUNT Real Estate Capital Partners (MOUNT) is the successor company to BNS Real Estate Capital. MOUNT offers partnership and advisory services relating to entrepreneurial real estate projects. We support small to medium-sized project developers and builders and investment and asset managers with their project developments and investments in existing properties offering value enhancement potential. Our focus is on the structuring and procurement of tailored project financing. As co-investor, we provide equity capital and arrange mezzanine and debt finance. As required, we are on hand to support the whole process, from site acquisition through to successful local development planning and placement of the assets with end investors. Our partners have full access to both our know-how and our robust networks.

Completed projects

Billion total investment

%

Mezzanine yield

Target Groups

Services

MOUNT offers co-investments and services in connection with real estate projects.

Acquisition

Contract

Investment Phase

Joint Venture structure

Investment Strategy

MOUNT stands for investments in sustainably liquid markets in combination with a clearly defined investment focus.

Concentration on metropolitan regions and their catchment areas. Also B and C-grade city locations with good prospects for the future and suitable locations for special uses

Land developments

Project developments with existing, or potential for, local development planning

Properties and portfolios with development potential (value-add properties)

perienced project developers with appropriate levels of equity commitment

Target returns on mezzanine loans: 8% – 12% p.a.

Investment horizon: 18 – 36 months

Asset-Classes

Residential

Location

- Locations with positive population growth forecasts

- Highly-developed supply functions and social infrastructure (schools, children’s day nurseries, healthcare amenities)

- Good connections to public transport and road networks

Concept

- Condominium and/or rental apartments

- Medium to high-standard

- Good level of pre-sales or pre-lets prior to commencement

Logistics

Location

- Good connections to public transport and road networks, if possible at established transport hubs

- Good availability of specialised personnel

- Preference for building land reserves for potential expansions on-site

Concept

- Technical fit-out allowing for good third party usability

- Variable use formats

- Ecologically sustainable building type

- Appropriate occupancy rate

Office

Location

- City centre locations

- Good connections to public transport and road networks

- Highly-developed supply infrastructure

Concept

- High degree of space efficiency

- Potential for flexible floor layouts

- Certifications (DGNB etc.) applied for

- Appropriate level of pre-letting

Retail

Location

- Locations with positive demographic prospects/populations >5,000

- Central locations or favourable positions close to principal transport routes

- No oversaturation by comparable retail sectors

Concept

- Currently only projects with a strong food retail anchor tenant

- Retail parks or food stores in combination with drugstore operators

- Existing properties with clear value-add components

Hotel

Location

- Large cities and metropolitan regions

- City centre locations

- Good connections to public transport and road networks

Concept

- Preference for 3 to 4-star hotel categories

- Experienced hotel operator with impeccable creditworthiness

Retirement / healthcare

Location

- Locations with extensive catchment areas

- Short distances to public transport connections

- Good availability of convenience retail functions

- Appropriate care provision with doctors and pharmacies in the immediate vicinity

Concept

- Care homes/assisted living/outpatient care

- Clinics and rehabilitation facilities

- Long-term leases with high-credit operators

- Detailed analysis of the competitive situation

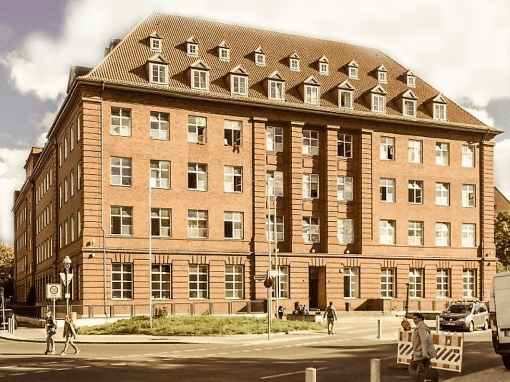

Track Record

Track-Record

Team

We are an entrepreneurially motivated and inter-disciplinary team with a flat hierarchy and a high degree of commitment. We have significant expertise in both the development and investment segment and the financing sector and are able to leverage this for the benefit of our business partnerships. We are able to speak professionally and eye-to-eye with our partners on both sides of the deal.

Senior Management

The senior management team and the staff of 12 have many years of experience and a tried-and-tested network in the real estate and finance economy.

Roger Neumann

Managing Partner

Christoph Wittkop

Managing Partner

Senior Advisor

Busso v. Alvensleben

Mob.: +49 172 310 54 94

Profile

Role:

- Acquisition of investments

- Acquisition of co-investors

Affiliations:

- Managing Partner of BvA Real Estate GmbH, Berlin

- Partner of Red Square GmbH, Neu-Isenburg

CV:

1999 – 2004

Member of the management board of Deutsche Real Estate AG, Berlin

1993 – 1999

Managing Director of CBC Immobilien-Entwicklungs GmbH, Berlin

1986 – 1993

Managing Director of Hammerson GmbH, Frankfurt am Main

1979 – 1986

Associate in the transactions division of Jones Lang Wootton, Hamburg

Angelika Kunath

Mob.: +49 172 431 16 15

Profile

Role:

- Acquisition of investments

- Acquisition of co-investors

Affiliations:

- Lecturer and member of the advisory board of Biberach University of Applied Sciences

- Member of the advisory board of a closed-ended property investment fund

- Member of the supervisory board of a real estate investment management company

- Active as freelance consultant

CV:

01/2006 – 12/2014

Managing Partner of Fondshaus Hamburg/Managing Director of Immobilienwerte Hamburg

09/1995 – 12/2005

Managing Director of HGA Capital, Hamburg

09/1988 – 08/1995

Lehndorff Vermögensverwaltung/Behne Immobilien, Hamburg

Stefan Theisen

Mob.: +49 151 72 91 73 50

Profile

Role:

- Acquisition Investments

- Acquisition of co-investors

Affiliations:

- Executive Partner

- Theisen & Cie. Real Estate Ltd.

CV:

2008 – 2015

- Various positions at Hamburger Sparkasse AG, Commercial Real Estate Investors

2001 – 2007

- National Director Ernst & Young

1995 – 2001

- Branch manager at two real estate leasing companies

Thilo Wagner

Mob.: +49 151 148 063 56

Profile

Role:

- Acquisition Investments

- Exit design of connected project developments after completion

Affiliations:

- Managing partner Values Health GmbH

- Managing Director Values Prime Locations GmbH

CV:

01/2013 – 07/2021

- Managing Director Nuveen Real Estate / TH Real Estate, Frankfurt

07/2002 -12/2012

- Director / Head of Acquisition Henderson Global Investors Ltd., Frankfurt

07/1998 – 06/2002

- Arthur Andersen Real Estate GmbH, Authorized Signatory and Head of Real Estate Investments, Eschborn

07/1994 – 06/1998

- M.M. Warburg Schlueter & Co. Employee Investment, Hamburg and Berlin

- DTZ Zadelhoff GmbH employee real estate valuation, Frankfurt

Team Members

F. Albérn-Schümmer

Management Assistant

Denise Albers

Investment Manager

Svenja Fischer

Team Assistant

Tatjana Schetle

Authorized signatory / Investment Manager

Murat Sen

Authorized signatory / Investment Manager

Contact

We look forward to talking to you and hearing your ideas!

Please visit us at:

MOUNT Real Estate Capital Partners

Alsterufer 3

20354 Hamburg

Give us a call on:

Tel.:+49 40 468 986 918

You can e-mail us at:

contact@mount-recp.de